A family trust can significantly simplify matters for your loved ones upon your passing or incapacity, but the trust document itself is rarely the issue. The real challenges arise from follow-through details such as deeds not recorded, bank accounts not retitled, and beneficiary forms that override trust provisions. Without proper funding and documentation, families may face the very probate process the trust was designed to avoid.

The essential objective is to maintain a funded family trust with all necessary documentation in place. NY Wills & Estates specializes exclusively in estate planning—including wills, trusts, Medicaid planning, and estate tax strategies—and holds licenses in both New York and New Jersey. Their dual-state expertise, with offices in Manhattan (450 7th Avenue) and Hackensack (15 Warren Street), is crucial when family or property spans state lines.

Three Things That Actually Make a Family Trust Work

Most families begin with a simple hope: “I want this to be easy for my spouse and kids.” That’s a completely reasonable goal—and getting there is often simpler (and more specific) than you might expect.

First, a family trust only protects what you actually put into it. Your deed has to be recorded. Your bank accounts and brokerage accounts need to be retitled in the trust’s name. Your retirement account and life insurance beneficiaries have to match your overall plan. Skip that follow-through, and your family can end up in probate court anyway—even though “the trust exists.” This happens more often than you’d think, even with six-figure estates that should have been straightforward.

Second, “family trust” isn’t a single product. A revocable living trust is typically about smoother administration, more privacy than probate offers (keeping family assets off the public record), and a cleaner handoff if you become incapacitated. An irrevocable trust usually tackles different problems—long-term care planning (where the 5-year Medicaid lookback period for nursing home benefits becomes critical), tax planning strategy, or asset protection. Irrevocable trusts come with real trade-offs in control, though. The right type of trust depends on the specific problem you’re solving, not the label on the document.

Third, management is where most people underestimate the work involved. Your trustee isn’t just a name on paper—it’s an actual job. Recordkeeping, dealing with banks, maintaining property, making distributions, and communicating clearly all fall on this person’s shoulders. Choose the wrong trustee or leave your instructions too vague, and you can accidentally create conflict and delays for your beneficiaries. The best plans feel almost boring because they’re so well organized: a funding checklist, a proof folder, and a simple annual review rhythm.

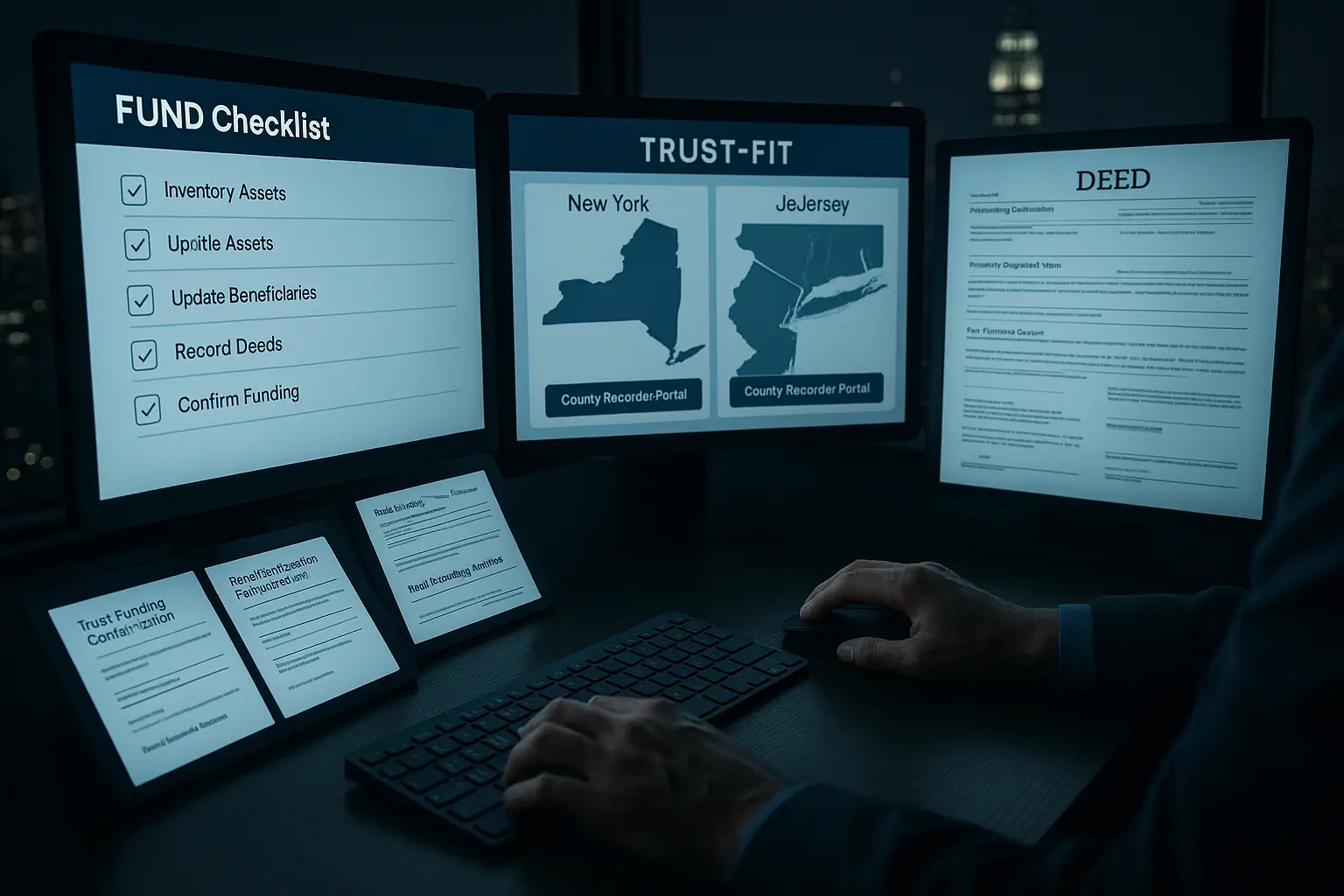

If you want to move forward quickly, use the interactive tool on this page as a quick fit check. Then use the FUND checklist below as your action plan. That combination turns family trust planning from a good intention into something your family can actually rely on.

Who Does What in a Family Trust

At its core, a family trust is a legal arrangement where one person (the grantor, also called the settlor) creates the trust and transfers assets into it. A trustee then manages those trust assets for beneficiaries according to written instructions in the trust document. When the trust is properly funded, it can help certain assets skip probate entirely and provide a much smoother plan if you become incapacitated.

Expert Insight

One thing I see surprise people all the time is that setting up a family trust is about much more than signing paperwork. At NY Wills & Estates, I’ve worked with so many clients who thought that once the documents were notarized, everything important was finished. But the reality is that the true work and protection come from thoroughly organizing and actually retitling assets—that hands-on process is where most plans either succeed or fall short for families later on.

What I’ve come to appreciate is that each family’s needs are shaped by their assets, relationships, and goals. In New York and New Jersey, local laws and property quirks make it even more important to understand which type of trust fits and how to fund it properly. A family trust can be incredibly powerful, but only if the details match your real life and you keep everything up to date. It’s not about complexity—it’s about making decisions now that actually work when it matters most.

·

NY Wills & Estates Team

| Role | What They Do |

|---|---|

| Grantor | Creates the family trust and transfers assets into it (also called settlor or trustor) |

| Trustee | Holds and manages trust assets according to the terms of the trust; owes fiduciary duties to beneficiaries |

| Successor Trustee | Steps in if the original trustee dies, resigns, or becomes incapacitated |

| Beneficiary | Receives income or assets based on the trust instructions |

Here’s how it works in practice: Say Susan creates the Smith Family Trust in Westchester, NY. As the grantor, she serves as trustee while she’s alive and able. If she becomes incapacitated, her successor trustee steps in to pay bills and manage trust assets—without any court involvement. After Susan’s death, the trustee distributes assets to her children (the beneficiaries of the trust) based on the trust terms. No probate needed for trust-held property[1]. (Assets outside the trust, including those passing through a pour-over will, may still require probate.)

When Does a Family Trust Make Sense?

Own real estate in New York or New Jersey? The family trust question gets practical fast. Probate isn’t just a legal concept—it can mean months of waiting, public filings, and avoidable stress during a time when your family members need things to run smoothly. In New York, the probate process in Surrogate’s Court often takes 9 to 18 months[2] for routine estates, and significantly longer if anything is contested or the estate is complex. New Jersey’s process generally moves faster, but estate administration still involves paperwork, deadlines, and public filings.

Incapacity planning matters just as much. If you’re alive but unable to manage money, your family may need a clear legal path to pay bills, handle property, and deal with banks—without scrambling for court involvement.

A family trust is usually worth a close look if you own NY/NJ real estate (whether that’s a primary home, rentals, a vacation property, or property in more than one state), you care about keeping financial details out of public court files, you want a smoother plan for incapacity, or you have a complex family situation like a blended family, minor children, or beneficiaries who need structure.

Most families land in one of three camps. If you own NY/NJ real estate and also care about privacy or incapacity planning—or you have beneficiaries who need structure—a family trust is likely a strong fit. Your next step is building a funding plan (deeds, accounts, beneficiaries), not just drafting documents. If you want incapacity protection and easier administration, but most of your assets are beneficiary-driven (retirement accounts, life insurance) or already have POD/TOD designations, the answer depends on the details. Run through the FUND checklist to see what a trust would actually need to touch. If you have no NY/NJ real estate, straightforward beneficiaries, and accounts already have clean POD/TOD designations, a family trust may not be necessary right now. Focus instead on confirming your will, power of attorney, health care documents, and beneficiary forms are consistent and current.

Timing matters. Funding a family trust often involves transferring assets and recording deeds, which can collide with real-life events. Mortgage lenders and co-op/condo boards (especially in NYC) have their own procedures for trust transfers. Don’t assume—confirm requirements early so you don’t stall a sale, refinance, or closing. Red flags to pause on before transferring anything include a pending sale, refinance, or HELOC application (you may need lender instructions first), unclear title (old deeds, missing owners, prior transfers not recorded), co-op board approval requirements (some boards may decline to approve trust transfers), and mortgage consent questions.

What You’ll Learn From This Guide

This guide will help you decide whether a family trust truly fits your situation and financial goals, follow a practical funding checklist so your trust actually works, and anticipate NY/NJ friction points—deeds, county recording, lender policies, co-op/condo rules, and beneficiary forms—so you know what to ask and what proof to keep.

To keep things manageable, here’s a realistic time estimate: the interactive tool takes about 5 minutes for a quick fit check. The FUND checklist takes 15 to 30 minutes if you have your statements and deeds handy. An attorney review meeting is typically one focused session once your inventory and checklist are complete—often faster and less expensive than starting from scratch.

By the end, you should have a clear trust-fit direction (likely yes, maybe, or likely no for now), a basic asset inventory (what you own, how it’s titled, and which institutions hold it), and a funding action list you can print or save to bring to your estate planning attorney, title company, or bank. If you’re weighing your options, reviewing how trust planning is commonly used in NY/NJ can help clarify your direction—especially for real estate, incapacity planning, and beneficiary protections.

The FUND Checklist: Your Step-by-Step Setup Guide

Most family trust problems aren’t legalese problems—they’re practical ones. The wrong trustee choice. An account that never gets retitled. A deed that never gets recorded. A beneficiary form that overrides the trust. The FUND checklist catches those gaps early.

FUND stands for Fit (confirm a family trust solves your actual problem), Understand (know the rules and paperwork steps for your state, county, and financial institutions), Name & Nominate (choose trustees, successors, and beneficiaries that work in the real world), and Do the Funding (move assets into the trust and prove it, then review periodically).

In New York and New Jersey, local nuances aren’t minor details. For real estate especially, county recording practices, lender policies, and building rules can be the difference between a family trust that works and one that creates delays later.

F: Is a Family Trust the Right Fit?

Family trusts are powerful estate planning tools, but they’re not automatic upgrades over wills. A trust is usually most valuable when you’re solving one or more of these problems: probate avoidance for key assets (particularly real estate and certain accounts that would otherwise require court involvement to transfer), incapacity planning (so your successor trustee can step in without a court guardianship process), beneficiaries who need structure (minors, beneficiaries with special needs, or situations where you want staged distributions), and privacy (since family assets held in a trust generally avoid the public record that comes with probate filings).

Rule of thumb: If two or more of those factors apply, it’s usually worth exploring a family trust seriously—not just drafting, but mapping out exactly how funding will happen.

When a family trust may be more than you need: If your assets are primarily retirement accounts and life insurance with updated beneficiary designations, and you don’t need ongoing controls or special planning, you may meet your financial planning goals with a will, powers of attorney, and clean beneficiary designations. Many families, though, still choose a trust for incapacity planning and smoother administration.

| Situation | Often a Better Fit | Why |

|---|---|---|

| NYC condo + taxable investment account | Family Trust | Streamlines transfer, supports incapacity planning, improves privacy vs. probate |

| One checking account + IRA (beneficiaries updated) | Will + beneficiary/POD designations | May transfer efficiently without a trust if no ongoing controls needed |

| Blended family + minor child | Family Trust | Allows customized distributions and ongoing management, reducing conflict risk |

U: Understand the Legal and Paperwork Steps

This is where shortcuts cause expensive cleanup later. Creating a family trust is one step. Funding it is a series of real transfers. Real estate is the biggest trouble spot because deed and recording requirements are strict, vary by state, and sometimes differ by county.

Before you sign documents or transfer assets, gather the facts that drive the paperwork. For real estate, you’ll need your most recent deed(s), the exact legal ownership currently on title, and any mortgage details. For bank and brokerage accounts, pull recent statements showing how each account is titled now. For beneficiary designations, get copies of current beneficiary forms for retirement accounts and life insurance—don’t rely on memory. And gather any existing planning documents: wills, powers of attorney, health care proxies, and prior trust paperwork.

Then confirm the must-do steps for your situation. Trust signing formalities depend on the trust document type and your state’s laws—many trusts are signed with a notary, and some situations call for witnesses. Your attorney should direct the proper execution method. For real estate, confirm the exact county clerk or recorder office where the deed must be recorded, and whether that office has formatting, cover-sheet, or submission rules. New York conveyances commonly require forms such as TP-584 and RP-5217, even when no money changes hands (though requirements may vary by county and can change—verify current requirements before recording). New Jersey commonly uses an Affidavit of Consideration for certain transfers, plus additional cover sheets depending on the county.

If there’s a mortgage, confirm the lender’s process before transferring title. If you own a co-op or condo—especially in NYC—board and managing-agent requirements can be a make-or-break step. Financial institutions often require a Certification of Trust (or similar summary) and may have their own review process before retitling accounts.

PRACTICAL MOVE

Before recording any deed or moving major assets, make one confirmation call or send one email to your county recording office (or a title professional) and your lender or managing agent if real estate is involved. That small step can prevent months of rework.

N: Name the Right People

A family trust is only as strong as the person—or institution—running it. The trustee manages trust funds, keeps records, follows the terms of the trust, and owes fiduciary duties to beneficiaries. Many families choose a trusted individual. Some use a professional or corporate trustee when neutrality, complexity, or long-term management is a major concern.

When choosing a trustee, look for reliability and organization (someone who can handle paperwork, deadlines, and recordkeeping), financial judgment (the trustee may need to make investment and property decisions), good boundaries (especially important if there’s potential family tension), and availability with named backups (always name successor trustees and spell out how replacements are chosen).

Individual trustees are most common—less expensive and more personal, but the job can be time-consuming, and family dynamics can complicate things. Corporate or professional trustees (offered by various trust companies and bank trust departments) work best for long-term trusts, complex assets, or high-conflict situations. You’ll pay more, but you gain consistency and neutrality. Co-trustees can balance strengths—one person knows the family, another handles finances—but decisions may be slower, and you’ll need a tie-break mechanism in the trust document.

Your family trust should be explicit about practical powers: managing and selling real estate, handling repairs, hiring professionals, and making distributions. It should also address whether the trustee can be compensated and how successor trustees step in. Many families ask their attorney to confirm in writing whether a bond waiver is included (bonds add cost and delays) and how trustee resignation and replacement work.

Example: If your primary trustee is an adult child who travels constantly, naming a reliable successor trustee—and even a third backup—prevents a future scramble if the first choice can’t serve.

D: Do the Funding (and Keep Proof)

Funding is where you actually align ownership and beneficiary designations with your plan. It’s also the most common reason families end up in probate even though “a family trust exists.”

For real estate, funding means preparing, signing, acknowledging, and recording a new deed into the trust—plus completing any required state/county forms. Keep the recorded deed and receipt as proof. For bank and brokerage accounts, retitle accounts into the trust or open new trust-titled accounts, following each institution’s rules, and obtain written confirmation. For beneficiary designations, coordinate retirement accounts and life insurance with the trust. In many cases, individuals are named directly as beneficiaries. In others—like minor beneficiaries or special needs planning—a properly drafted trust may be the better beneficiary. This coordination requires care because beneficiary forms typically override the trust terms if they conflict, and naming a trust as beneficiary of retirement accounts can have significant tax implications that should be reviewed with your attorney and tax advisor.

Keep a proof folder—digital and paper—with recorded deeds, confirmation letters, and copies of beneficiary forms. Many families formalize this with a Trust Funding Confirmation document listing each asset, what was done, and what proof exists.

UPKEEP

After significant life changes such as major life events, opening new accounts, refinancing, property transactions, marriage or divorce, or family births and deaths, it’s important to review your funding. A practical routine for most families includes a 30-day check post-signing, a 90-day check to ensure all retitling is complete, and an annual review. This rhythm helps maintain clarity and control.

For each review, use a straightforward sign-off list that notes what has been completed, what remains pending, and where the supporting documentation is stored. This simple process ensures nothing is overlooked and proof is easily accessible when needed.

Revocable, Irrevocable, and Specialty Trusts Explained

“Family trust” is a broad term that encompasses different types of trusts. The type of family trust you choose affects flexibility, control, taxes, and asset protection in different ways.

Revocable living trust: This type of living trust is the most common for everyday estate planning. The grantor can change or revoke it during their lifetime as long as they have capacity. People typically use it to avoid probate for trust-owned assets, improve privacy, and provide a smoother incapacity plan. A revocable trust generally does not protect assets from your creditors and is not, by itself, a Medicaid asset-shielding strategy.

Irrevocable trust: These are used for more advanced planning—potentially including tax planning strategies, estate taxes reduction, creditor protection, and certain long-term care and Medicaid planning approaches. In exchange, you generally give up significant control, and changing the trust later can be difficult or impossible without specific legal mechanisms. An irrevocable family trust offers potential tax benefits and asset protection that revocable trusts cannot provide. For nursing home Medicaid, there is a 5-year lookback period for certain asset transfers, and timing is critical. (This lookback applies specifically to institutional Medicaid for nursing home care; other Medicaid programs may have different rules.) If long-term care planning is a real concern, learn how Medicaid planning and irrevocable trust strategies fit your timing, health situation, and risk tolerance. Generic documents can create serious problems if they don’t match NY/NJ rules.

Bypass trust: Also called a credit shelter trust, this type of trust is designed to help married couples minimize estate taxes by preserving each spouse’s estate tax exemption. When the first spouse dies, assets up to the exemption amount can fund the bypass trust, providing for the surviving spouse while keeping those assets out of their taxable estate. This strategy can help preserve family wealth for future generations while still providing income and support to the surviving spouse during their lifetime.

Specialty trusts: A spendthrift trust restricts a beneficiary’s access and can help protect against that beneficiary’s creditors in many situations (though certain creditors, such as the IRS or child support claimants, may still have collection rights). A special needs trust supports a person with disabilities without breaking eligibility for government benefits like SSI and Medicaid—if drafted and administered correctly under federal and state rules. These trusts have specific requirements, and the rules differ depending on whether the trust is funded by the beneficiary’s own assets or by a third party. A testamentary trust[3] is created under a will and provides ongoing management after death, but it doesn’t avoid probate because it doesn’t exist until the will is admitted.

PRACTICAL TIP

Ignore buzzwords. Start with the problem you’re solving—privacy, incapacity planning, beneficiary protections, long-term care planning, or wealth management for future generations—then match the tool to that.

How a Family Trust Works at Each Life Stage

Management is where your family trust either earns its keep or becomes another document gathering dust. A good trust plan makes it obvious who does what, when, and where the proof lives.

While You’re Healthy

As trustee of your own revocable family trust, you keep using your assets much the same way—but certain assets are now titled in the trust’s name. During your lifetime, a revocable trust typically uses your Social Security number for tax purposes[4] (you don’t need a separate EIN until after death or, in some cases, incapacity). As the grantor, you’re responsible for keeping records, especially for major transactions involving trust property (real estate repairs, refinancing discussions, large transfers). And you keep the funding list current so new accounts and property don’t accidentally sit outside the plan.

If You Become Incapacitated

Your successor trustee steps in to manage trust-owned assets, pay expenses, and keep things stable—without court involvement (assuming the trust terms and any required documentation, such as physician certification, are satisfied). Banks usually require paperwork (commonly a Certification of Trust and sometimes a doctor’s letter, depending on the institution and trust terms). Real estate management becomes immediate: property taxes, insurance, repairs, tenants, and sale decisions don’t pause just because someone is ill.

After Death

The trustee gathers information and secures trust assets, then follows the trust instructions for paying expenses and making distributions to beneficiaries. Some assets still pass outside the trust—retirement accounts and life insurance typically pass by beneficiary designation, which is why beneficiary coordination is part of good family trust planning. Taxes and reporting depend on the trust type. Many non-grantor irrevocable trusts require an IRS Form 1041 income tax return, and the trustee may need to obtain an EIN using IRS Form SS-4. Even revocable trusts typically need an EIN after the grantor’s death[5].

The practical standard: Your trustee should be able to open one folder and find the trust document, the list of trust assets, the recorded deed(s), the latest account statements showing trust titling, and current beneficiary confirmations. That’s what reduces panic and prevents mistakes.

NY and NJ-Specific Rules You Need to Know

NY/NJ family trust planning gets more technical when real estate is involved. State laws, county recording practices, and building and lender policies all come into play.

Common friction points include county recording requirements (formatting, cover sheets, and required forms differ by state and county—mistakes lead to rejected filings), transfer documentation (even when no money changes hands, states often require disclosures or tax-related forms with the deed transfer), lender policies (some lenders require review and prior written consent before transferring assets into trust while a loan is outstanding), and co-op and condo rules (co-ops may require board approval and some may decline to approve trust transfers; condos may require notice or specific steps).

A simple three-step approach will help you confirm local requirements. First, check the county clerk/recorder website for recording instructions, fee schedules, and required cover sheets, and whether e-recording is available. Second, ask for current acceptance details before you submit—some offices will confirm formatting rules, common rejection reasons, and sample cover sheets. Third, get exceptions in writing when possible. If a lender, managing agent, or title professional gives you special instructions, keep the email or letter in your funding proof folder.

When you call a title company, managing agent, or county recording office, these practical questions save time: “Do you have a checklist for recording a deed into a family trust in this county?” “What are the most common reasons deeds get rejected here?” “What forms are required for a no-money transfer into a trust?” “If the property is mortgaged, do you require lender-consent documentation with the recording package?” “For a co-op/condo, what approvals or notices are required before transfer?”

Which Situations Call for a Family Trust?

The benefits of a family trust increase with complexity—and with the need for ongoing management, not just as a transfer mechanism.

| Situation | Trust? | Reason |

|---|---|---|

| NY/NJ real estate (primary or investment) | Often yes | Simplifies transfer, supports incapacity planning, reduces probate involvement for trust-titled assets |

| Income property (multi-family, mixed-use, commercial) | Often yes | Preserves management continuity and avoids delays if owner becomes incapacitated |

| Most assets have POD/TOD and beneficiaries are straightforward | Often no | May be handled efficiently with beneficiary designations + will + strong POA/health documents, unless you need controls or privacy |

| Blended family, special needs, or high-conflict heirs | Often yes | Allows custom distribution terms and protections that reduce dispute risk |

Trade-off: Family trusts typically cost more upfront (commonly $2,500–$5,000 or more[6] for attorney-drafted trusts with funding support in the NY/NJ market, though fees vary based on complexity and attorney) and require follow-through. The payoff is often a smoother transition and fewer emergencies later.

Setup Timeline: What to Expect

Most family trust setups happen in three phases. Timelines vary based on how quickly you can gather documents, whether real estate is involved, and how responsive banks and other institutions are.

Planning and drafting typically takes 1 to 4+ weeks[7]—clarifying goals, gathering documents, and reviewing drafts. Signing is usually 1 to 2 weeks, depending on scheduling. Funding often takes 2 to 8+ weeks, sometimes longer—retitling accounts, preparing and recording deeds, and updating beneficiary designations. Real estate, lender consent, and co-op/condo approvals can extend this significantly.

Common bottlenecks and how to avoid them: For lender approvals, ask early and request written instructions—don’t wait until the week you want to record. For county recorder backlogs or rejections, confirm formatting and required forms before submission, and use experienced title and recording help for deeds. For incomplete beneficiary paperwork, request current beneficiary confirmations from each institution and keep copies in your proof folder.

The single best way to reduce delays and legal fees? Bring a real inventory to your first meeting—deeds, account statements, and copies of beneficiary designations, not just a rough list. This is also where specialized focus helps. A firm that regularly handles family trusts in both NY and NJ is less likely to treat deed transfers, recording forms, and bank requirements as an afterthought. Working with attorneys whose practice is limited to estate planning means the process is designed around getting from draft to funded with fewer loose ends.

How to Spot and Fix Funding Problems

The most common family trust failure is incomplete funding: assets that never make it into the trust, or aren’t properly directed to it, may still require probate or transfer in ways you didn’t intend.

Other frequent issues include conflicting beneficiary forms (beneficiary designations on retirement accounts and life insurance typically control, even if your trust says something else), real estate not properly transferred (if the deed isn’t prepared and recorded correctly, the property may still be outside the trust), and institution pushback (banks and brokerages may require extra documentation or specific forms before retitling accounts, and processing times vary).

Quick audit to discover issues: For title, confirm the current owner on record for each property—don’t rely on memory, verify with the county records or a title search. For account titling, look at the registration line on bank and brokerage statements to confirm whether the trust is actually named. For beneficiaries, request current confirmations from retirement plan administrators and life insurance carriers. Then cross-check everything against your funding list—every asset should have an action (retitle, record, beneficiary update) and proof stored.

Prioritized repair plan: Fix real estate first (often the highest stakes)—corrective deed preparation and recording as needed. The timeline depends on county recording turnaround and any lender/building requirements. Correct beneficiary mismatches next—update forms directly with the institution and obtain a confirmation copy. Then retitle financial accounts—escalate to the institution’s trust/estates processing team, submit their required certification, and request written confirmation when complete. Finally, close the loop by updating your Trust Funding Confirmation document and storing recorded deeds, letters, and forms together.

Who to contact for what: Deed and title problems usually require an estate planning attorney or title company. Lender-consent issues require the lender’s assumption or servicing department. Account retitling and beneficiary changes require the institution’s designated processing team, not just a local branch.

Why urgency matters: Funding errors are far cheaper to fix while you’re alive and competent than after death or incapacity, when court processes and disputes can multiply costs.

What Does a Family Trust Cost in NY or NJ?

Costs depend on complexity—especially real estate, how many assets must be retitled, and how much funding support is included. The biggest cost surprise for families is often not the trust document itself. It’s the deed work, recording requirements, and back-and-forth with financial institutions.

Flat-fee packages often cover drafting and signing. Some include deed preparation and funding guidance—ask exactly what “funding” means in any quote. Hourly billing is more common for complex situations (multiple properties, business interests, contested family dynamics, sophisticated tax or Medicaid planning). DIY/template options have lower upfront cost but higher risk, especially when NY/NJ real estate deeds and recording forms are involved.

| Item | NY Considerations | NJ Considerations | Notes |

|---|---|---|---|

| Attorney-drafted family trust | Often higher fees in downstate markets. Confirm whether deed prep and recording coordination are included. | Fees vary widely. Confirm whether funding support is included or billed separately. | Request a written scope: drafting, signing, funding support, and post-signing follow-up. |

| DIY/template | Higher risk of missing NY-specific deed forms and recording requirements. | Higher risk of missing NJ county-specific submission requirements and affidavits. | If real estate is involved, consider attorney review before recording anything. |

| Recording/transfer fees | County fees apply. Reporting forms may be required even when transfer taxes are exempt. | County fees apply. Affidavits/cover sheets may be required for exempt transfers. | County practices change. Verify current requirements during the Understand step. |

HOW TO AVOID COST SURPRISES

Request a detailed, written estimate that clearly separates the costs for drafting and signing, deed preparation and recording coordination, account retitling support, and any post-signing audit or funding confirmation steps to ensure full transparency and avoid unexpected fees.

Family Trust vs. Will: Making the Right Choice

Many strong estate plans use both a family trust and a will, plus beneficiary designations. Each tool does a different job.

A family trust holds and manages assets privately, can reduce probate involvement for trust-owned assets, and supports incapacity management—but only if funded. A will is often used as a “pour-over will” to capture assets left outside the trust at death (those assets will still go through probate before being transferred to the trust). A will is also where you typically nominate guardians for minor children. POD/TOD and beneficiary designations can transfer certain accounts quickly, but don’t provide the same ongoing controls and don’t replace incapacity planning for non-trust assets.

Decision factors that usually settle this quickly: What you own (real estate and taxable accounts often push toward a family trust; beneficiary-driven assets may not), your privacy tolerance (if you strongly prefer avoiding public probate filings, a funded trust is often the cleanest route), your incapacity concern (if you want a smoother transition for asset management, a trust can be central—again, for assets actually in the trust), and your budget and willingness to follow through (a family trust can be excellent, but only if you complete funding and keep proof).

Guiding principle: If you want privacy and ongoing control, a funded revocable family trust plus a well-drafted backup will is often the most robust solution. When building or updating the backup layer of your plan, reviewing your will planning options alongside any trust work keeps everything consistent—especially for families with children or blended-family concerns.

Use Our Tool to Check Your Family Trust Fit

Use the interactive trust-fit tool as a structured gut check—not a final legal verdict. A good tool helps you gather the details that actually control the outcome and flags timing issues before you trigger expensive rework.

At minimum, be ready to enter or look up whether you own NY/NJ real estate (and whether it’s mortgaged, or a co-op/condo), basic estate size and asset mix (real estate, taxable accounts, retirement, life insurance), any special-needs beneficiaries, minors, or higher conflict risk, your privacy and incapacity priorities, and whether beneficiary forms are current and who is named.

Most trust-fit tools produce one of three outcomes, each with a different next step. If a family trust is likely recommended, move immediately to the FUND checklist and start building your funding plan. If it could go either way, complete the checklist and schedule an attorney review meeting to confirm which assets should be in the trust and which should pass by beneficiary designation. If a family trust is likely not necessary right now, focus on will + POA/health documents + beneficiary cleanup, and re-check if you buy NY/NJ real estate or your family situation changes.

If you identify urgent issues—pending transactions, unclear title, co-op restrictions, or lender-consent requirements—pause and confirm next steps with a qualified NY/NJ estate planning attorney before moving assets.

How to Organize Your Next Steps

Family trust planning works when your actions match your paperwork. The families who have the smoothest outcomes do two things well: they stay organized, and they assign responsibility for each funding step.

Step 1: Gather Your Documents

Preparation reduces delays and legal fees, and makes any tool output more accurate. Bring or gather digitally: property addresses, deeds, and mortgage details (plus lender contact information), recent statements for every bank/brokerage account (ideally showing full account numbers), copies of beneficiary designations (retirement accounts and life insurance), your first-choice and backup trustees (with contact details), and any known complications (divorce, disputes, pending sale/refinance, unclear title).

If you complete a tool or checklist, save the output (PDF or spreadsheet) and share it with your attorney. This is often the difference between a productive single meeting and a series of follow-ups.

Step 2: Track Your Progress

The simplest way to prevent missed funding is to track each asset the same way: what action is required, who will do it, when it’s due, and what proof you’ll keep. Share this list with your attorney and, if real estate is involved, your title company—so everyone works off the same map.

| Asset | Action Needed | Responsible Party | Deadline | Proof of Completion |

|---|---|---|---|---|

| Primary residence | Deed transfer + county recording | Attorney/title company | MM/DD/YYYY | Recorded deed + receipt |

| Savings account | Retitle to trust | You / bank representative | MM/DD/YYYY | Written confirmation from institution |

| IRA | Confirm/update beneficiaries | You / plan administrator | MM/DD/YYYY | Beneficiary form copy |

Update the tracker after any major life event or financial change. For extra thoroughness, attach or link the actual proof documents to each row in a secure digital folder.

Step 3: Get Written Answers From Your Attorney

Clear answers prevent misunderstandings, especially around deeds and funding responsibilities. Request a written summary covering why a family trust is (or isn’t) recommended for your goals, what must be recorded for each property and where, whether lender consent is required (and what documentation to obtain), the trustee and successor trustee plan (including backups and whether co-trustees make sense), who’s responsible for each funding step and how follow-ups will be handled, and any expected transfer-tax reporting forms, exemptions, or county-specific requirements.

Questions that prevent surprises: “Which county office will we record in?” “What forms must accompany the deed?” “Do you recommend a deed transfer now or after a refinance?” “Will your office handle recording and return of the recorded deed, or is that on me?”

Red flag: If responsibilities are unclear—especially around deed recording and account retitling—you’re more likely to end up with an incomplete, ineffective family trust plan.

Step 4: Schedule Funding and Regular Check-Ins

Funding goes smoother when it’s sequenced correctly, then audited on a schedule. Start by confirming lender/building requirements (and getting written consent where needed) before transferring title for mortgaged or restricted property. Then prepare and record deeds correctly, keeping certified or recorded copies. Next, retitle bank and investment accounts and obtain written confirmation. Update beneficiary forms for retirement accounts and life insurance so they align with the overall plan. Finally, complete or refresh your Trust Funding Confirmation and store it with your proof folder.

Sample follow-up timeline: 30 days (what’s been submitted), 90 days (what’s confirmed complete), and 365 days (annual review and updates). In most families, the grantor and attorney coordinate the initial push, and the successor trustee should know where the proof folder and confirmation documents live.

About This Guide

This guide is provided for informational purposes and helps you ask better questions, organize documents, and avoid common mistakes. It isn’t legal advice for your specific facts. NY and NJ rules, lender practices, and county procedures can change, and local recording offices may apply requirements differently.

Review and updates: This guide is reviewed and updated periodically by the estate planning attorneys at NY Wills & Estates.

For any plan involving real estate, blended families, special needs planning, meaningful tax concerns, or long-term care/Medicaid planning, confirm details with a qualified New York or New Jersey estate planning attorney. Coordinating with a financial advisor can also help ensure your family trust aligns with your broader personal finance and wealth management strategy.

Downloadable Tools

Good tools won’t replace legal advice, but they help you stay organized and make professional meetings more productive. Helpful tools for family trust planning include a funding checklist (fillable PDF and spreadsheet versions) to map each asset to a specific action, Trust Funding Confirmation templates to document completion and store proof, county comparison notes for common recording requirements and frequent deed-filing mistakes, timeline visuals covering drafting, signing, funding, and annual reviews, and a sample one-page Answer Sheet to request from your attorney so responsibilities and local rules are clear.

Keep a master copy for your successor trustee. Years later, those records can mean the difference between a smooth transition and a frustrating search for critical documents. As a best practice, confirm how often any download is updated and whether it’s attorney-reviewed for NY/NJ changes.

Resources for Your Specific Needs

Your best next step depends on what you own and what you’re trying to protect. NY/NJ real estate owners should focus on deed retitling and county recording requirements (and lender/co-op/condo approval timing). Families with special needs beneficiaries should use a special needs trust explainer and work with a specialist to protect government benefits properly—these trusts have specific legal requirements that vary based on funding source and beneficiary circumstances. For trustee handoff planning, use a trustee responsibilities checklist and recordkeeping guide so your successor can step in without confusion. For complex or tax-driven planning, learn about different types of trusts including irrevocable trust options and coordinate with your CPA and financial advisor.

For complicated scenarios, a focused consultation is often most efficient after you’ve assembled your deeds, statements, and beneficiary information.

Frequently Asked Questions

-

How Do I Choose Between a Family Trust and a Will?

Start with the Fit criteria in the FUND checklist. If you own NY/NJ real estate, want stronger incapacity planning, care about privacy, or have beneficiaries who need structure (minors, special needs, conflict risk), a family trust is often justified. If none of those apply—and your accounts are set up with clear POD/TOD and beneficiary designations—a will plus updated forms may be enough. For a quick directional answer, try the interactive tool, then validate with the checklist.

-

What Does a Family Trust Cost in NY vs. NJ?

Costs vary by complexity, real estate, and how much funding work is included. In the NY/NJ market, attorney-drafted family trusts with funding support commonly range from $2,500 to $5,000 or more, though fees can run higher for complex situations. The most important cost question: does your quote include funding support (deeds, recording coordination, account retitling) or just documents?

-

Do I Need a Family Trust Just for Bank Accounts?

Usually not, if POD/TOD designations are clean and beneficiaries are straightforward. A family trust can still be useful, though, if you want a single, organized system for incapacity planning, or if you want post-death controls (like staged distributions) that POD/TOD designations don’t provide. Use the Fit indicators as your decision filter.

-

How Do I Fund a Family Trust for NY/NJ Real Estate?

Funding real estate typically requires the correct deed for your situation, proper notarization/acknowledgment, confirmation of lender/building rules, recording with the correct county office along with required reporting forms (which vary by state and county), and retaining proof (recorded deed/receipts)—plus updating your Trust Funding Confirmation.

-

How Do I Update a Family Trust After Major Life Changes?

Revocable family trusts are designed to be changeable, but changes should be made through formal amendments (or a restatement) prepared and executed correctly. After a major life event, re-check funding and beneficiary designations so the real-world paperwork still matches the plan. Many mistakes happen when the document is updated but accounts and beneficiaries aren’t. Use the follow-up rhythm (30/90/annual) as your maintenance system.

-

Does a Family Trust Protect Assets From Creditors?

A revocable family trust generally provides little to no asset protection because you still control the assets. Some irrevocable trusts can provide stronger protection—but only if designed and administered correctly, and they often involve meaningful trade-offs in control. Even irrevocable trusts may not protect against all creditors (certain government claims, child support, and other obligations may still reach trust assets depending on the circumstances).

-

What Are the Tax Advantages of a Family Trust?

A revocable living trust by itself doesn’t change your income tax rate or provide direct tax advantages during your lifetime—you report trust income on your personal return. However, certain types of trusts offer meaningful tax benefits. Irrevocable trusts can potentially reduce estate taxes for larger estates. A bypass trust can help married couples maximize both spouses’ estate tax exemptions, preserving more wealth for beneficiaries. For families concerned about estate taxes, working with both an estate planning attorney and financial advisor on tax planning strategies is essential.

-

When Should I Use an Attorney vs. Online Tools?

Online tools can help you get organized, but real estate transfers, beneficiary coordination, and NY/NJ-specific execution and recording requirements can create expensive mistakes if handled incorrectly. If you own NY/NJ real estate, have a complicated family situation, or are doing special needs or long-term care planning, have a qualified NY/NJ estate planning attorney guide the plan and funding steps. If the tool or checklist raises red flags (lender consent, co-op approval, county recording requirements), get written attorney confirmation before signing or recording anything.

Ready to Create Your Family Trust Plan?

Deciding between a will-based plan and a family trust-based plan? The most helpful next step is usually a focused conversation that answers two practical questions: Which documents and strategy fit your family and assets? And exactly how will your family trust be funded (property, accounts, and beneficiary forms) so it works when it matters?

Call NY Wills & Estates at 516-518-8586 to schedule a consultation. During that conversation, you can discuss your specific estate planning needs with an attorney who focuses on this area, get clear answers about which strategies are right for your situation, understand the legal requirements specific to New York or New Jersey, and receive a personalized plan of action with transparent guidance on next steps.

This is your opportunity to get focused counsel from attorneys who practice estate planning exclusively—so you can move forward with confidence, clarity, and a family trust plan designed to be completed, not just drafted.

Understanding the full scope of setting up a family trust is crucial to protecting your legacy and ensuring your wishes are honored. NY Wills & Estates offers expert guidance tailored to New York and New Jersey families, helping you build a comprehensive, legally sound estate plan—schedule a consultation today to create clarity and confidence for your family’s future.

References & Sources

- 1

Matus Law Group. (n.d.). What Is Probate in New Jersey? ⚖️. Matus Law Group.

https://matuslaw.com/your-guide-to-new-jersey-probate/

Accessed: 2026-02-16

- 2

Fratello Law. (2026). Understanding the Probate Process in New York State Surrogate’s Court: A Complete Guide for Long Island Families. Fratello Law.

https://fratello-law.com/probate-process-new-york-surrogates-court-guide/

Accessed: 2026-02-16

- 3

MetLife. (n.d.). Testamentary Trust: Definition & How It Works. MetLife.

https://www.metlife.com/stories/legal/testamentary-trust/

Accessed: 2026-02-16

- 4

Stephanie Bivens. (2025). Does my Trust need a Tax Identification Number (TIN), also known as an Employer Identification Number (EIN)?. Bivens & Associates.

Accessed: 2026-02-16

- 5

twarnock16. (2024). Understanding the Tax ID Number for a Revocable Trust While Living. Warnock Law Group.

Accessed: 2026-02-16

- 6

ss-admin. (2025). How Much Do Trust And Will Services Cost In Hackensack, NJ?. Choi Firm.

https://www.choifirm.com/blog/how-much-do-trust-and-will-services-cost-in-hackensack-nj/

Accessed: 2026-02-16

- 7

Berg Bryant Elder Law Group, PLLC. (n.d.). How Long Does it Take to Complete an Estate Plan?. Berg Bryant Elder Law Group, PLLC.

https://www.bbelderlaw.com/how-long-does-it-take-to-complete-an-estate-plan/

Accessed: 2026-02-16

Our Editorial Standards

NY Wills & Estates is committed to providing accurate, well-researched legal and estate planning information. Our editorial team reviews all content for accuracy and relies on reputable sources including legal authorities, governmental agencies, academic institutions, peer-reviewed journals, and established healthcare providers. All references are verified for accessibility and relevance at the time of publication.

We strive for accuracy in everything we publish, but we recognize that mistakes can occur and information can become outdated as legal guidelines, statutes, and regulations evolve. If you notice an error or outdated information, please contact us so we can review and update our content.

Important Disclaimer

The information provided on this website is for general informational and educational purposes only. It is not intended as, and should not be interpreted as, professional legal, financial, or tax advice. Always consult with qualified healthcare professionals, licensed practitioners, or appropriate advisors before making decisions about your estate planning, legal, financial, or tax matters. NY Wills & Estates does not assume liability for actions taken based on the information presented on this site.