Blended families face some of the toughest estate questions: How do you honor bonds from a first marriage without leaving your new spouse or children from previous relationships feeling overlooked? Who inherits when family ties overlap?

These questions are especially prevalent today, as over 50% of U.S. families are currently remarried or re-coupled (per the Step Family Foundation).

Clear planning is the only way to avoid conflict and protect everyone you love. Without thoughtful preparation, even the closest families can end up in disputes over assets, beneficiary designations, or the intentions behind your estate documents.

Ultimately, a well-crafted estate plan gives everyone peace of mind and helps prevent confusion when it matters most.

In this article, you’ll find estate planning tips that can help blended families in New York create plans that reflect their values, protect loved ones, and provide clarity after a spouse’s death.

Estate Planning for Blended Families: Top Strategies

(1) Clarify Your Wishes Early

In a blended family, assuming everyone knows your personal wishes can lead to confusion. Take time to create estate plans that clearly explain how you want to divide assets among your biological children, adult children, and your current spouse.

For example, you might want your surviving spouse to use the family home during their lifetime but have it eventually pass to your own children. A well-structured marital trust can help you accomplish that goal while avoiding unnecessary estate taxes and reducing the need for probate court oversight.

(2) Consider a Prenuptial Agreement

A prenuptial agreement isn’t just for protecting assets during divorce. It can also clarify expectations about separate property, inheritance rights, and beneficiary designations if a spouse dies. This helps your loved ones avoid disagreements over estate assets or the deceased spouse’s assets down the road.

If you didn’t sign a prenuptial agreement before marriage, you can still create a postnuptial agreement to set clear guidelines.

(3) Use Trusts to Protect All Family Members

Trusts can help you balance support for a surviving spouse with your wish to leave assets to children from a first marriage or prior relationship. For example:

- A marital trust can provide income to your new spouse while reserving the principal for your biological children after your spouse passes.

- An irrevocable trust can help protect certain assets from creditors or preserve them for minor children.

- A separate trust can be set up to hold a family business or bank accounts earmarked for one child or a group of children.

Be sure to name a qualified attorney, a corporate trustee, or another neutral successor trustee to handle trust administration and help maintain positive family relationships.

(4) Review Beneficiary Designations and Titles

Assets like life insurance policies, retirement plans, and jointly owned property pass automatically to the primary beneficiary you’ve named. If your designations are out of date, they could conflict with your estate planning documents and create tension among family members.

Review your beneficiary forms regularly, especially after the first spouse dies or if you remarry. Keeping these records updated helps your plans stay in line with your current wishes.

(5) Think About Tax Implications

The unlimited marital deduction allows married couples to leave assets to a surviving spouse without federal estate taxes. However, when the surviving spouse’s death occurs, those assets could become part of their taxable estate.

If you want to leave a portion of your estate to children from a previous marriage or deceased spouse’s children, consider whether a marital trust or irrevocable trust can help reduce tax burdens and protect inheritances.

(6) Talk About Your Plans

Even the most carefully drafted plan benefits from open communication. Discussing your intentions with your adult children, current spouse, and other beneficiaries helps set expectations and lowers the chance of confusion or disputes later.

Work With a Knowledgeable Estate Attorney

Planning for a blended family means more moving parts—and more chances for confusion and strife if details are left unresolved. In fact, over a third (35%) of U.S. adults report that they or someone they know has experienced familial drama because of a lack of estate planning (per research from WealthCounsel).

Partnering with a qualified estate attorney helps you put every piece in place and avoid unnecessary pain, drama, and misunderstandings. Here’s how experienced guidance can make all the difference:

Evaluate Your Family Dynamics

Your attorney will start by helping you map out your family relationships, including children from a prior marriage, stepchildren, and beneficiaries with different needs.

This process brings clarity to who you want to protect and how you want to divide assets after you or your spouse passes. It can also help you steer clear of common estate planning mistakes that could cost you thousands.

Identify and Protect Separate Property

In blended families, it’s common for each spouse to bring separate property into the marriage. Your attorney can help you determine which estate assets should remain separate and which should be shared with your new spouse.

Whether you have a family business, real estate, or retirement plans that you’d like to pass to your own children, clear documentation reduces the chance of disputes later on.

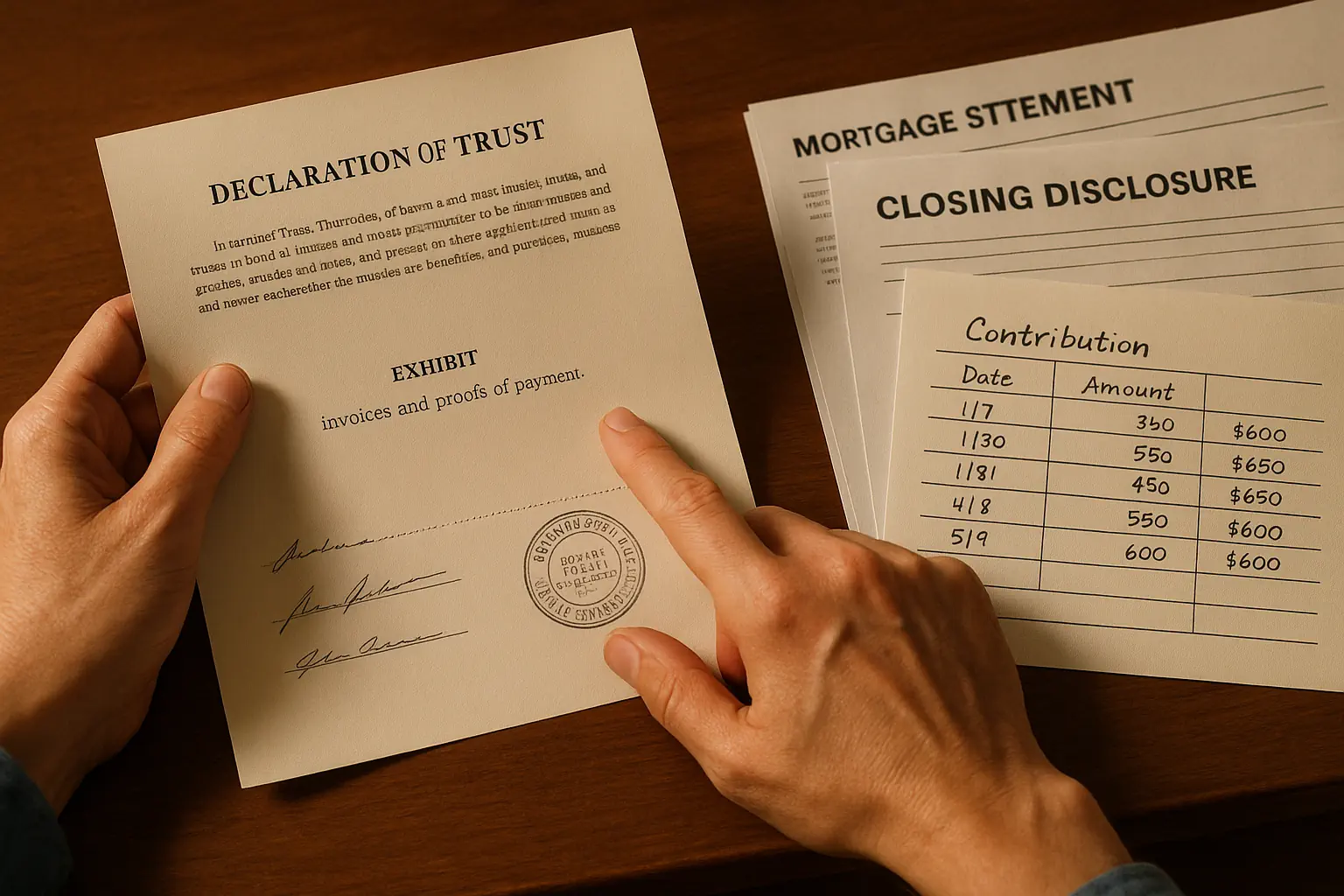

Draft Clear Estate Planning Documents

Your plans won’t carry legal weight without carefully prepared documents. A knowledgeable attorney can draft or update:

- Wills naming beneficiaries from previous relationships and your current family

- Marital trusts or irrevocable trusts to support a surviving spouse while protecting inheritances for children

- Prenuptial agreements or postnuptial agreements clarifying rights to certain assets

- Healthcare powers and a durable power of attorney for financial decisions if you become unable to manage your affairs

These documents help keep your estate out of probate court and limit the risk of a probate judge making decisions you wouldn’t have wanted.

Review Tax Implications

A skilled attorney will help you consider how New York estate taxes and the unlimited marital deduction could affect your plans. They can also recommend strategies—like funding a marital trust—to reduce tax burdens and preserve more for your loved ones.

Update Beneficiary Designations

Your attorney can assist you with reviewing beneficiary designations on life insurance policies, bank accounts, and retirement plans. This step helps your estate planning documents work in harmony with your account titles so that distributing assets happens the way you intend.

Provide Guidance During Administration

When a spouse dies, your attorney can guide the successor trustee or executor through trust administration or probate proceedings. This support helps your family handle responsibilities during a difficult time and reduces the chance of conflicts over the trust’s assets or distribution of property.

Blended families deserve estate plans built with care and foresight. If you’re ready to explore your options, speak with an experienced estate planning attorney who can help you protect your wishes and support every member of your family.

Let’s Build a Plan That Honors Every Branch of Your Family

At the Law Offices of Vlad Portnoy P.C., we help blended families across New York create estate plans that respect every relationship and protect what matters most.

Whether you’re updating documents after a previous marriage, setting up a marital trust, or planning for adult children and a surviving spouse, our team will guide you through any and all unique challenges. These aren’t things you have to face alone, nor should you.

Start building a plan that reflects your values and protects your legacy.