In most states, Medicaid does not cover the full assisted living bill. While it may pay for certain care services, residents typically must pay for room and board out of pocket, making it essential to understand what Medicaid will and won’t cover before committing.

The biggest mistake families make is trusting a verbal “yes, we take Medicaid” without obtaining detailed, program-specific confirmation in writing. To avoid costly surprises, it’s crucial to have one solid plan plus two backup options—such as home care, rehab, or alternative facilities—so you’re never forced into expensive decisions under pressure.

If you’re trying to figure out how to pay for a parent’s, spouse’s, or your own assisted living care, you’re not alone—and you’re asking exactly the right questions. The problem is that the answers aren’t always straightforward, and the stakes are high. Making decisions based on assumptions or verbal reassurances can lead to thousands of dollars in unexpected bills.

This guide walks you through what Medicaid actually covers, how the application process works (especially in New York), and how to protect yourself and your loved one from the most common financial pitfalls. Everything here is designed to help you make a real decision—not just gather information that leaves you more confused than when you started.

Three Things That Prevent Surprise Bills

Before diving into the details, there are three fundamental truths that can save you from the most painful outcomes. Understanding these upfront changes how you approach every conversation with assisted living facilities and agencies.

Medicaid coverage for assisted living usually means a split bill. Here’s what catches most families off guard: in the majority of states, Medicaid does not pay for the housing portion of assisted living. That means your room, your meals, your basic facility overhead—that’s on you. What Medicaid may cover is the care component: personal care assistance, supervision, and certain health care services. But this only happens through specific state Medicaid programs, often called home and community-based services (HCBS) waivers or managed long-term care[1]. If you plan for that split from the beginning, you won’t be blindsided by a bill you thought would never arrive.

“We take Medicaid” isn’t a plan—a named program in writing is. When a facility tells you they accept Medicaid, that’s the beginning of a conversation, not the end of one. In New York, “Medicaid assisted living” typically means enrollment in the Assisted Living Program (ALP), and only certain assisted living facilities actually participate. Your real protection comes from getting written confirmation that names the exact program, spells out the billing policy, and clarifies what happens while your Medicaid application is pending. Staff change. Policies shift. A verbal yes means nothing if you can’t point to it on paper later.

Eligibility has three parts, and you need all of them. Getting into a Medicaid-funded assisted living arrangement requires the facility’s program-specific acceptance, a current needs assessment that meets the eligibility requirements, and properly organized income and asset documentation. Miss any one of these pieces, and you risk losing your spot, paying months of private pay rates while things get sorted out, or languishing on a waitlist indefinitely. That’s exactly why having two backup options ready before you commit to anything—such as home care services, short-term rehab, or a second facility—matters more than most people realize.

When You’re Actually Ready to Move Forward

A friendly tour and reassuring words from admissions staff feel good, but they’re not your green light. The real decision point comes when you can verify the essentials on paper and have contingency plans ready if something falls through.

Expert Insight

I’ve noticed that many people are genuinely surprised by how complicated the question of whether Medicaid pays for assisted living can be, especially in New York and New Jersey. The most common misconception is that once someone qualifies for Medicaid, it automatically covers everything in an assisted living facility, when in reality, Medicaid only covers specific services and not all costs. This misunderstanding can lead to some tough financial surprises, so it’s always valuable to break down what is and isn’t included before making any decisions.

In my experience at NY Wills & Estates, families really benefit from understanding the state-specific Medicaid programs and how eligibility rules and coverage can differ so much—even from one side of the Hudson to the other. What I find helpful is focusing on getting all commitments in writing and having realistic backup plans, since availability and requirements can shift quickly. The more organized and informed you are at the outset, the better protected you’ll be against sudden changes or unexpected gaps in coverage.

·

NY Wills & Estates Team

You’re genuinely ready when you have facility acceptance in writing under the correct Medicaid pathway (in New York, that means a document explicitly stating ALP, not just generic Medicaid acceptance). You also need medical eligibility backed by a current assessment showing you meet the program’s required level of care. Your financial documentation should be complete and current—income verification, asset statements, everything organized and matching. And you should have two backup options you can activate quickly if the first choice doesn’t work out.

Until all of these pieces are in place, hold off on major commitments. Large deposits, long-term contracts, moving money around—these decisions should wait. Skipping even one verification step is precisely where families get burned, usually through unexpected private pay bills or a devastating “actually, you don’t qualify” surprise weeks into the process.

The Triggers That Actually Speed Things Up

When everything feels overwhelming, focus your energy on these three areas. Getting them right dramatically reduces your financial risk and turns vague maybes into concrete yeses.

| Trigger | Why It Matters | What “Verified” Looks Like |

|---|---|---|

| Written facility acceptance | Prevents misunderstandings and last-minute reversals | A dated email or letter naming the specific program (like ALP), outlining next steps, and providing a contact person |

| Completed needs assessment | Medicaid doesn’t approve anyone based on “seems like a good fit” | Formal assessment results plus a documentation checklist from the appropriate assessment channel |

| Current financial documentation | Many delays trace back to missing statements or inconsistencies | Recent income proof, complete account statements with all pages included, and a clean paper trail where names and addresses match across documents |

Timing genuinely matters here. ALP slots can be capped, and waitlists aren’t hypothetical—they’re common. Families who maintain continuity of care tend to be those who started building a parallel plan early, whether that’s home health care, rehab, or a carefully structured private-pay bridge, rather than betting everything on a single opening materializing at the perfect moment.

What Medicaid Actually Covers (and What It Doesn’t)

Most families assume Medicaid works in assisted living facilities the same way it works in a nursing home. It doesn’t, and this misunderstanding is at the heart of most financial surprises.

In most states, Medicaid does not pay for the housing portion of assisted living. This means your room, meals, and basic facility operations—collectively called “room and board”—are your responsibility. What Medicaid may cover, depending on your state and specific waiver program, is the service component: hands-on help with activities of daily living like bathing, dressing, toileting, and transferring; medication management and reminders; supervision and care coordination; and some nursing-related services.

The practical reality? Even when someone is “on Medicaid in assisted living,” there’s usually still a monthly amount the resident must cover for room, board, and personal expenses. A handful of states offer more comprehensive coverage, but New York follows the typical split-bill model that most states use.

Understanding Your Care Options

In New York State, when people talk about the “Medicaid assisted living program,” they’re almost always referring to the Assisted Living Program, or ALP. This is a designated program delivered in state-approved adult care facilities that provide residential care. Not every building that markets itself as “assisted living” can provide ALP services or bill Medicaid.

Avoid the “we take Medicaid” trap

Get a curated list of New York facilities that actually participate in ALP—so you can focus your calls on places that match the correct Medicaid pathway and reduce the risk of surprise bills.

Includes what to ask for in writing (ALP confirmation, billing policy, pending-period terms) and how to verify participation before you tour.

ALP tends to work well for people who can’t safely live alone but don’t require around-the-clock skilled nursing. Home care through programs like managed long-term care (MLTC) or HCBS waiver services may be a better fit if someone can remain at home with adequate supports, including in-home personal care services and home health aides. Nursing home Medicaid offers the most comprehensive coverage—including room and board—but requires a higher level of medical need. Regular assisted living on a private-pay basis suits people who are more independent or who have long-term care insurance, but Medicaid options are typically limited in these settings.

| Setting | Best For | Typical Care Needs |

|---|---|---|

| NY ALP | People needing regular daily living help in a staffed residential community | Hands-on personal care, supervision, medication reminders |

| Regular Assisted Living | More independent individuals wanting lighter help or optional services | Housing and meals included; care packages available for purchase—flexible but costly long-term |

| Nursing Facility | People with high medical needs requiring 24/7 skilled nursing care | Nursing home care, rehab therapy, complex medication management |

| Home Care (HCBS Waiver) | Those who want to stay home with visiting support | Visiting aides, nursing visits, equipment, caregiver coordination |

One critical consideration: if someone is falling frequently, wandering due to Alzheimer’s or another cognitive condition, can’t manage toileting safely, or needs consistent overnight supervision, it’s worth having a frank conversation about whether ALP provides enough support—or whether nursing home level care is a better match for their actual needs.

The CARE Checklist: Your Reality Check

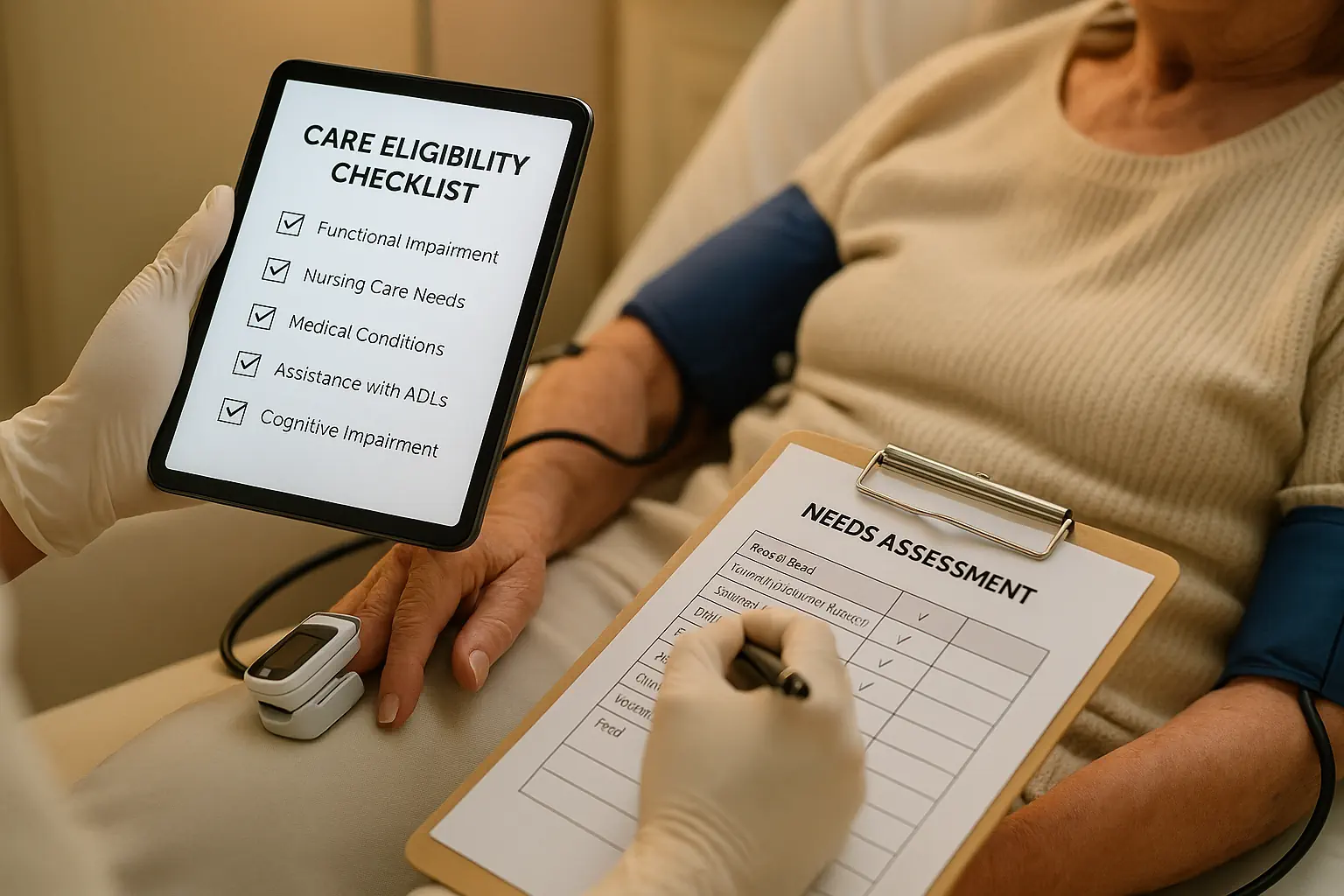

Before committing to anything, run through this framework. It mirrors how real ALP decisions actually unfold in practice, and it keeps you from moving forward on false assumptions.

C — Criteria: Do you actually meet the medical and financial eligibility criteria for the specific program you’re pursuing? Not what you’ve heard or assumed—what the documentation shows.

A — Acceptance: Do you have documented, program-specific acceptance or confirmed waitlist status from the facility? Verbal assurances don’t count.

R — Resources and Rights: Do you understand what you’ll pay monthly, what Medicaid covers, what income the resident keeps, and how disputes get resolved?

E — Exit and Emergency Plan: What happens if the opening disappears, needs change, or approval takes longer than expected? What are your two backup options?

PLANNING TIP

If any “yes” response cannot be supported by a document, consider it as “not yet.” Methodically addressing these items helps reduce your financial risk and safeguards your options should unforeseen issues arise.

What Documentation You’ll Need

Medicaid eligibility lives and dies by paperwork. Many denials and delays happen not because someone doesn’t genuinely need help, but because their file doesn’t prove it clearly, consistently, and with current records.

You’ll need to gather photo ID and proof of residence, clinician notes with specific dates describing functional limitations and supervision needs, hospital or rehab discharge paperwork if the situation is time-sensitive, Social Security or SSI (Supplemental Security Income) award letters along with pension proof, complete bank statements for all accounts covering the required period (including every single page, even the blank ones), and proof of other assets like brokerage accounts, IRAs, or life insurance cash value.

Watch out for the pitfalls that trip up even organized families: missing pages from a statement PDF (this is one of the most frequent reasons cases get sent back for additional information), forms that aren’t dated or releases that aren’t signed, name or address mismatches across different statements, and conflicting medical descriptions between providers with no explanation of the discrepancy. When you’re uncertain, provide complete records rather than summaries. Medicaid offices need full statements or official PDFs—not handwritten totals or screenshots.

Getting Confirmation in Writing

Facilities change availability, staffing, and policies—sometimes overnight. A verbal “yes, we take Medicaid” offers zero protection when you need it most. Before signing anything, paying a deposit, or moving in, get documentation of a dated acceptance or waitlist confirmation naming the specific program (in New York, that means explicitly stating ALP), proof of current program participation or licensing, and written billing policies showing exactly what you pay versus what Medicaid covers—especially during any pending period.

Here’s an email you can copy, paste, and send:

Subject: Request for written ALP confirmation, billing policy, and availability

Body: Hi [Name], we’re exploring placement for my [relationship]. Can you please confirm in writing: (1) whether your community currently participates in New York’s Assisted Living Program (ALP), including license and program details; (2) whether you have an ALP opening—if not, our waitlist status and next steps; (3) an itemized breakdown of what the resident pays (room and board and any fees) versus what’s billed to Medicaid under ALP; and (4) if you offer private pay while Medicaid is pending, the written conversion terms, rate, and refund policy. Thank you—please reply by email so we can keep it in our records.

After any phone conversation, follow up with an email summarizing your understanding and asking for confirmation. Save the reply as a PDF. This simple habit has prevented countless disputes.

Understanding What You’ll Actually Pay

The most common financial shock families experience is assuming Medicaid covers the entire assisted living bill. In most cases, it doesn’t—and the costs of assisted living can add up quickly. Ask every facility for a written, itemized breakdown that separates charges and explains what happens during pending periods.

| Invoice Item | Questions to Ask | Documentation to Request |

|---|---|---|

| Personal care services / ALP services | “Once approved, is this billed under ALP? What happens while Medicaid is pending?” | Written billing policy stating ALP billing and pending-period details |

| Room and board | “Is this always the resident’s responsibility, even after ALP approval?” | Admission agreement plus rate sheet separating room/board from care services |

| Amenity or activity fees | “Is this optional? Can it be declined? Does it change after approval?” | Optional-services list with prices and separate consent forms |

Be especially wary of a single line item like “Monthly care package” that blends housing, meals, and services together. If you can’t clearly tell what Medicaid covers versus what’s your responsibility, request a reissued breakdown. You’re not being difficult—you’re preventing a dispute that could cost you thousands.

When you need to push back, try this: “We’re not asking you to change your rates. We’re asking you to put in writing what’s billed to Medicaid under ALP versus what remains our responsibility, including during any pending period. If there’s a conversion from private pay to ALP billing, we need those terms in writing.”

Finding the Right Eligibility Limits

Families understandably want simple numbers: an income limit and an asset limit. The challenge is that the correct limit depends on the Medicaid category and specific pathway, and New York updates these figures regularly.

Rather than risk relying on outdated numbers, take this approach: Look up current Medicaid income and resource levels on official NYS Department of Health and local social services resources (LDSS or HRA websites, which often have .gov domains). Confirm which category applies to your situation—single versus married, community-based long-term care versus institutional Medicaid, and any special eligibility status. Print or save the page with the date so everyone in your family is working from the same reference point.

When preparing your file, focus on how countable amounts are documented. For income, start with gross monthly sources like Social Security, pension, and annuity payments, then confirm what deductions or program-specific rules apply. For assets, list each account separately and attach complete statements—don’t merge balances without backup documentation. If you’re married, understand that Medicaid rules often include spousal protections and allowances that can mean the difference between eligibility and denial.

One important nuance: Medicaid look-back and transfer-penalty rules are clear and strict for nursing home (institutional) Medicaid—traditionally a 60-month look-back[2] in most states including New York. For community-based long-term care pathways like home care and ALP, rules and implementation can differ. Always get program-specific guidance before making any transfers. And if you appear to be over the asset limit, speak with an elder law attorney before moving money. Common “solutions” like adding your child to an account can create penalties, denials, probate complications, or tax problems that cost far more than they save. If you’re close to the asset threshold, understanding spend-down rules is also essential—you may need to reduce countable assets before Medicaid benefits begin.

Proving Medical Eligibility

To qualify for ALP or similar Medicaid long-term care services, you need to demonstrate a meaningful need for help—often comparable to what might qualify someone for nursing-home-level care, while still being appropriate for an assisted-living environment.

To make your assessment go smoothly, schedule through the proper channel (often coordinated by your local department of social services, HRA, a managed care plan, or a contracted assessment entity). Bring recent supporting records from doctors, home health care providers, therapists, and hospitals—especially anything describing help needed with bathing, dressing, toileting, transfers, continence management, and supervision. If someone is coming from a hospital or rehab facility, ask for a discharge summary that spells out ADL limitations and safety concerns.

When you ask your doctor for documentation, be specific:

“We’re completing a Medicaid long-term care assessment for assisted living (ALP). Could you provide a dated note listing the patient’s current diagnoses and functional limitations—specifically what help is needed with bathing, dressing, toileting, transfers, walking or wheelchair use, continence, medication management, and any supervision or safety needs like fall risk, memory concerns, or wandering? Please include how often help is needed and whether hands-on assistance is required.”

The goal isn’t to make things sound worse than they are. The goal is to be accurate, specific, and consistent across all documentation. Vague or contradictory records create delays; clear, honest descriptions move things forward.

Finding Assisted Living Facilities That Actually Participate in ALP

Start with official sources, then confirm directly with the facility in writing. In New York, the NYS Department of Health maintains facility listings and profiles that help identify adult care facilities and ALP participation status.

Use the state directory as your baseline—save or print the page with the date. Then contact the facility and ask them to confirm in writing that they currently accept assisted living residents through ALP and explain how their process works. If no slot is available, get written confirmation of your waitlist status.

Remember that directory listings can lag behind reality. Treat the directory as a starting point and the facility’s own written confirmation as the basis for any action you take.

When filtering your options, start with geography—county or borough plus realistic driving distance for family visits and caregivers. A wonderful facility that nobody can actually visit rarely works long-term. Look for licensing or program indicators suggesting ALP participation, then verify directly. Check “last updated” metadata where available, and save screenshots with URLs and dates. Rank your shortlist by verified ALP participation, waitlist status or availability, ability to meet the person’s medical care needs (mobility and cognition), and billing clarity.

Navigating Waitlists Without Losing Your Place

ALP openings can be limited, and submitting a partial Medicaid application can slow you down twice—first while you scramble to gather missing items, then again while you wait for reprocessing.

To protect your position, submit complete packets with all required statements and pages from the start. Ask how priority works—it may be first-come-first-served or influenced by factors like urgent discharge needs. Get the formal waitlist process in writing and save it with your records. If you’re considering a private-pay bridge while waiting, do so only with written conversion terms that spell out rates, timelines, and what happens if Medicaid is delayed or denied.

Here’s a real-world scenario: if a hospital discharge planner suggests ALP placement, request a written discharge plan and keep all dates in one timeline. That record becomes valuable if paperwork delays threaten your spot and you need to advocate for yourself.

The Step-by-Step Application Process for NY ALP

The safest approach moves in a straight line: program confirmation, then assessment, then financial submission. Following this sequence helps you avoid getting a yes from one party and a no from another.

- Confirm the facility’s ALP participation and get written acceptance or waitlist placement.

- Complete the required assessment—ask in advance what documents to bring.

- Build a clean financial packet: Social Security or SSI letters, pensions, full bank statements, other assets—all scanned into clearly labeled PDFs.

- Submit to the correct office (LDSS outside NYC, or HRA in NYC) following their specific submission requirements.

- Track everything: dates, names, what was submitted. A simple spreadsheet works fine.

- If something stalls, escalate in writing and attach your documented paper trail.

Understanding who does what helps immensely. Your family gathers documentation and coordinates with caregivers. The assessment channel conducts the level-of-care evaluation. You (often working with the facility) submit materials and confirm receipt. If finances or transfers are complicated, or you’re facing a denial, legal review can prevent costly rework and protect your appeal options.

Warning Signs That Should Make You Pause

Stop the process and get clarity in writing if you encounter any of these red flags. They’re not just inconveniences—they’re indicators that something may go wrong later.

Be concerned when a facility says “we take Medicaid” but won’t specify which program or put anything in writing. Watch out when different staff members give you different answers about availability, billing, licensing, or eligibility. Don’t sign a contract without a complete, itemized fee schedule and clear pending Medicaid policy. Be wary of pressure tactics like “sign today or lose it” that don’t give you time to review written terms. And take immediate action if you’re told you owe retroactive charges that weren’t disclosed in your written agreement.

When you hit any of these situations, stop money transfers until you have written clarification. Document every communication. Request the facility’s grievance and billing-dispute process in writing. If needed, consult a Long-Term Care Ombudsman, your local social services office, or an elder law attorney before signing anything.

If you’re facing a billing dispute, try this approach: “We’re happy to resolve this, but we need the policy and basis for this charge in writing. Please point us to the specific contract section or written billing policy that supports this amount, and confirm whether this is room and board or ALP-billed services.”

What to Do When ALP Isn’t Available

Because ALP capacity is limited, building a parallel plan means a missed opening or delayed approval doesn’t spiral into a crisis.

A private-pay bridge works only if you can genuinely afford it and have written terms about rates, refunds, and what “conversion” to Medicaid or ALP actually means. Home-based Medicaid long-term care through MLTC or HCBS waiver services can often support someone at home while you pursue longer-term placement—these programs may cover home health services, personal care assistance, and adult day care. Short-term rehab or skilled nursing may be appropriate after hospitalization while planning continues.

If you’re forced to choose between “a bed today” and clear terms, push for clear terms. A bridge arrangement without written conversion language is precisely where many surprise debts begin.

How ALP Actually Works in New York

Understanding why ALP outcomes sometimes feel inconsistent helps you navigate the process with realistic expectations. The rules families experience are shaped by an overlapping mix of licensing requirements, program contracts, enrollment caps, and local processing practices.

In New York, two government roles often get confused. The NYS Department of Health (DOH) oversees the broader state Medicaid program structure and publishes official guidance, including facility-related resources. Local District Social Services (LDSS) or HRA (in New York City) handles eligibility processing, required submissions, and local procedural requirements.

On top of that, facilities have their own participation status, contracts, and internal billing policies—and ALP slots can be limited. That’s why following procedures carefully pays off. Clean submissions and timely documentation don’t just speed things up. They preserve your waitlist position, reduce your exposure to pending billing, and protect your appeal rights if something goes wrong.

Your First 48 Hours: What to Do Right Now

If you’re dealing with a hospital discharge, urgent health decline, or another high-pressure situation, these steps keep your options open while you figure out the bigger picture.

First, save proof of program status by downloading or printing the facility’s official listing with the URL and date. Second, email admissions and billing requesting written acceptance or waitlist status, license and program confirmation, and a written, itemized billing policy for Medicaid/ALP residents—including what happens during pending periods. Third, build your financial PDF packet with photo ID, the most recent Social Security or pension proof, and complete account statements with all pages. Fourth, schedule the assessment and ask for the documentation checklist beforehand so you can bring discharge or therapy notes if available.

Who to Contact for Help

LDSS (outside NYC) or HRA (NYC): Medicaid eligibility questions, application routing, and procedural requirements. Note that they don’t provide legal advice.

NYS Department of Health: Program and facility licensing information, official facility listings.

Long-Term Care Ombudsman: An independent advocate for residents of nursing homes and assisted living facilities. They can help with resident rights issues, facility disputes, and billing or contract problems.

Local aging and benefits counseling networks: Help navigating resources and communications, including case management support.

Elder law attorney: Complex Medicaid planning, spend-down strategy, transfers, denials or appeals, and high-stakes financial questions.

Before sharing sensitive documents with anyone, confirm their scope and fees, and use secure storage and sharing methods.

Frequently Asked Questions

-

Does Medicaid pay for assisted living?

Medicaid can often cover care services in certain waiver programs, but it typically does not pay for room and board in most states, including New York.

-

How do I know if a facility truly accepts Medicaid or ALP?

Ask for written confirmation naming the specific program (such as ALP), plus the written billing policy and pending-period details.

-

What if we don’t have medical proof ready?

Use the clinician request language in this guide, and bring any discharge summaries or therapy notes to the assessment.

-

What if there are no ALP openings?

Get on the official waitlist with written confirmation, activate two backup options, and track every contact and deadline so you can escalate if necessary.

-

Will Medicaid cover the entire assisted living bill once approved?

Usually not. Even with ALP, room and board remains the resident’s responsibility. Always require a written breakdown showing the itemized costs.

-

How do we confirm a facility is ALP-licensed and not just “Medicaid-friendly”?

Start with DOH listings, then get written confirmation from admissions and billing that they currently participate in ALP and how they bill.

-

What documents prove eligibility?

Current medical records describing ADL and supervision needs, plus complete income and asset documentation including Social Security or pensions and full statements with all pages. Missing pages and mismatched names cause many delays.

-

How do we estimate out-of-pocket cost?

Focus on what you’ll pay for room and board and optional extras, then confirm whether any pending period is billed at a private-pay rate. Ask for a written monthly total and what triggers increases.

-

Does Medicare help with assisted living costs?

Medicare generally does not cover long-term residential care in assisted living facilities. Medicare may cover short-term skilled nursing or rehab stays, but it’s not designed for ongoing room, board, or personal care in assisted living settings.

-

What if my loved one has too many assets to qualify?

You may need to spend down assets to meet Medicaid’s asset limit. However, there are legal ways to protect certain resources. Consult an elder law attorney before transferring or spending assets, as improper transfers can trigger penalty periods.

NY vs. NJ: Key Differences to Know

Medicaid programs for assisted living are highly state-specific. Programs that sound similar can operate very differently across state lines.

| Program Area | New York | New Jersey |

|---|---|---|

| Common pathway | ALP in participating adult care facilities; limited slots; room and board typically separate | Medicaid Managed Long-Term Services and Supports (MLTSS); participation and facility caps vary |

| Financial rules | Change annually by Medicaid category; verify with LDSS/HRA and NYS DOH | Often uses different limits than NY; verify through NJ Medicaid/MLTSS resources |

| Access | Waitlists common in some regions | May have broader participation, but availability varies by facility and county |

If you’re comparing options across state lines—perhaps a parent in New Jersey with adult children in New York—treat a cross-state move as a completely new eligibility and licensing process. Verify program rules in the state where care will actually be delivered before signing any contracts or relocating.

NY Wills & Estates is licensed in both New York and New Jersey and focuses exclusively on estate planning and long-term care planning. That specialization proves especially valuable when your decisions involve not just care placement, but also questions about who can legally act for your loved one and how assets should be handled.

Staying Organized: Simple Tools That Work

You don’t need fancy software—you need consistency and records you can defend. Families who see the smoothest outcomes typically maintain a single folder (both paper and digital) containing statements, assessments, and letters. They keep a contact log documenting dates, names, titles, and outcomes. And they save PDFs or screenshots of all listings and emails so details can’t mysteriously “change later.”

Consider keeping an eligibility packet checklist tracking the applicant’s information, the program being pursued, facility written acceptance or waitlist proof, assessment status, submission office, and all included documents like photo ID, Social Security or SSI letters, pension proof, bank statements with all pages, brokerage statements, insurance cash value proof, clinician notes, and your contact timeline.

For phone calls, maintain a simple log noting the date and time, facility name, number called, who you spoke with (name and title), key answers about ALP participation and slot availability, whether pending billing policy was explained, whether written follow-up was promised, and next steps with due dates.

When requesting clinician documentation, keep it straightforward: “Please provide a dated note describing diagnoses and current functional limitations: ADLs (bathing, dressing, toileting, transfers, walking), continence, medication management ability, cognitive and safety concerns, and how often hands-on help or supervision is required. This is for a Medicaid long-term care assessment.”

If you ever need to appeal or escalate, you’ll want a ready-to-send letter: “I am requesting written clarification and status regarding Medicaid/ALP processing for [Name, DOB]. Attached are: (1) facility acceptance or waitlist proof, (2) assessment documentation, (3) indexed financial records, and (4) a timeline of communications. Please confirm what’s needed to complete review and the expected decision timeframe.”

Keeping This Information Current

Last reviewed: This guide is regularly updated to reflect current programs and requirements.

This guide is maintained to support real family decision-making. Because New York Medicaid rules and local procedures change, it relies on primary sources like NYS DOH and LDSS/HRA materials and program-facing documentation requirements. Content is periodically reviewed by professionals in long-term care planning. The approach is date-first: if you’re relying on a specific number, limit, or policy, confirm it on an official .gov site and save a timestamped copy.

If something on this page seems outdated or unclear, verify with LDSS/HRA or legal counsel before acting—especially before signing facility agreements or moving assets.

Legal and Privacy Notice

This guide provides general information, not legal advice. Medicaid eligibility and program access depend on individual circumstances—marital status, income type, residency, disability status, transfers, and program-specific rules. Always confirm current eligibility requirements with LDSS/HRA, the relevant plan or assistance program, or qualified legal counsel.

GOOD TO KNOW

Protect privacy by securely storing records, avoiding sending Social Security numbers via unencrypted email, and maintaining a clear log of what information you’ve shared and with whom.

The Bottom Line

The difference between families who navigate this smoothly and those who face financial surprises usually comes down to documented verification. Keep strong records. Insist on written answers. Match the facility to the correct Medicaid pathway. Maintain two backup options. Do that, and you avoid most worst-case scenarios: lost openings, preventable denials, and avoidable private-pay debt.

When families ask “Where do we even start?”, the most helpful beginning is usually a focused review of the care goal (ALP versus home care versus nursing home), the documentation, and the legal tools that prevent a second crisis later—like an outdated will, missing powers of attorney, or a care plan that unintentionally triggers probate delays. Depending on your situation, that might include:

- Medicaid and long-term care planning (eligibility strategy, documentation readiness, risk reduction): Medicaid Planning

- Trust planning (when appropriate for asset protection and smoother administration): Trusts

- Core estate planning documents (wills, guardianship planning, incapacity planning like powers of attorney and health care proxies): Wills & Estate Planning

Schedule Your Consultation

NY Wills & Estates is a specialized estate planning law firm licensed in both New York and New Jersey, serving families across the metro area with offices in Manhattan (450 7th Avenue) and Hackensack (15 Warren Street). The practice focuses exclusively on estate planning, wills, trusts, Medicaid planning, and estate tax strategies—so you get guidance tailored to your actual situation, not a one-size-fits-all checklist.

Call NY Wills & Estates today at 516-518-8586 to take the next step in protecting your family’s future. During a consultation, you can discuss your specific needs with a specialized attorney, get clear answers about which documents and strategies fit your situation, understand the legal requirements in New York or New Jersey, and receive a personalized plan with transparent next steps.

This is your opportunity to get focused counsel from attorneys who practice estate planning exclusively. Take the first step toward securing your family’s legacy.

Understanding Medicaid coverage for assisted living is just one part of protecting your family’s future; NY Wills & Estates offers expert, personalized estate planning tailored to New York and New Jersey families facing these complex challenges. Schedule a consultation today to create a clear, customized plan that safeguards your assets and provides lasting peace of mind.

References & Sources

- 1

Alatsas Law Firm. (n.d.). Understanding Long. Alatsas Law Firm.

https://www.alatsaslawfirm.com/library/a-guide-to-new-york-long-term-care-medicaid.cfm

Accessed: 2026-02-16

- 2

admin. (2024). What is the Medicaid “Look Back,” what is the “Penalty Period,” and how do they work?. Lamson & Cutner.

Accessed: 2026-02-16

Our Editorial Standards

NY Wills & Estates is committed to providing accurate, well-researched legal and estate planning information. Our editorial team reviews all content for accuracy and relies on reputable sources including legal authorities, governmental agencies, academic institutions, peer-reviewed journals, and established healthcare providers. All references are verified for accessibility and relevance at the time of publication.

We strive for accuracy in everything we publish, but we recognize that mistakes can occur and information can become outdated as legal guidelines, statutes, and regulations evolve. If you notice an error or outdated information, please contact us so we can review and update our content.

Important Disclaimer

The information provided on this website is for general informational and educational purposes only. It is not intended as, and should not be interpreted as, professional legal, financial, or tax advice. Always consult with qualified healthcare professionals, licensed practitioners, or appropriate advisors before making decisions about your estate planning, legal, financial, or tax matters. NY Wills & Estates does not assume liability for actions taken based on the information presented on this site.